5StarsStocks .com stocks are popular among investors looking for big gains. They’re picked for their strong performance and market-beating potential. Investing in the stock market can be tough, with so many choices. But finding top stocks can really boost your portfolio.

Learn more about the latest opportunities at 5StarsStocks .com.

By looking at the best stock picks and following expert advice, investors can make smart choices. This helps them keep up with market trends.

Key Takeaways

- Understanding the concept of 5-star stocks and their potential.

- Identifying top stock recommendations for investment.

- Gaining insights into expert investment advice.

- Staying updated with the latest stock market tips.

- Maximizing returns through informed investment decisions.

Understanding 5-StarStocks .com and Their Market Potential

The stock market is always changing. Knowing what makes a 5-star stock is key for smart investing. Expert analysis helps spot top stocks that might beat the market.

What Defines a 5-Star Stock Rating

A 5-star stock rating goes to companies with great financial health and growth. They also have a strong competitive edge. These stocks are seen as likely to do well over time.

Historical Performance of 5-Star Rated Investments

5-star investments have a history of beating the market. The table below shows how 5-star stocks have done compared to the market.

| Year | 5-Star Stocks Performance | Market Average |

| 2020 | 15% | 10% |

| 2021 | 20% | 12% |

| 2022 | 18% | 8% |

Current Market Conditions and Opportunities

Today’s market offers chances for investors. With the right analysis and news, finding 5-star stocks for growth is possible.

Understanding what makes a 5-star stock and keeping up with market trends helps investors. This way, they can make better choices for their portfolios.

Key Criteria for Identifying Market-Beating Stocks on 5starsstocks.com

5starsstocks.com uses a strict set of criteria to find top stocks. They look at many factors that help a stock succeed.

Financial Health Indicators

First, they check a company’s financial health. They look at revenue growth, profit margins, and debt levels. This helps understand if a company is stable and can grow.

- Revenue growth rate

- Profit margin analysis

- Debt-to-equity ratio assessment

Growth Metrics That Matter

They also look at growth metrics like earnings per share (EPS) and sales growth. These show if a company can grow and increase value for shareholders.

Competitive Advantage Assessment

Another key factor is a company’s competitive edge. They check market position, brand strength, and innovation. A strong edge helps keep market share and ensures success.

Management Quality and Corporate Governance

Lastly, they consider management quality and corporate governance. Good leadership and clear governance boost performance and investor trust.

By examining these criteria, 5starsstocks.com offers stock recommendations based on solid research. This helps investors make smart choices.

Top 5-StarsStocks .com with Exceptional Growth Prospects

Looking for top stocks? Check out 5-star rated companies on 5starsstocks.com. They’ve been carefully picked for their growth potential.

Technology Sector Leaders

The tech world is buzzing with innovation. Cloud computing and AI are leading the way. These innovators are making big strides and growing fast.

Cloud Computing and AI Innovators

Amazon Web Services (AWS) and Microsoft Azure are leading in cloud computing. They offer solutions that businesses love. Meanwhile, NVIDIA is exploring new AI frontiers.

The semiconductor industry is also booming. Intel and AMD are at the forefront. They’re making chips that make computers faster and more efficient.

Healthcare and Biotech Frontrunners

Healthcare and biotech are growing fast. Thanks to new medicines and medical devices.

Pharmaceutical Breakthroughs

Pfizer and Johnson & Johnson are leading in pharmaceuticals. They’re creating new treatments and vaccines that help people.

Medical Device Innovations

Medtronic is innovating in medical devices. Their new technologies are improving patient care and treatment options.

Financial Services and Fintech Disruptors

Fintech is changing financial services. Companies like PayPal and Square are making finance more accessible.

Consumer Goods and Retail Transformers

Consumer goods and retail are evolving. Companies are adapting to new consumer habits. Amazon is changing how we shop.

These 5-star stocks offer a mix of established leaders and new disruptors. They give investors many growth opportunities.

Why 5starsstocks.com Recommends These Market Outperformers

5starsstocks.com’s experts use a special method to find stocks with great growth potential. They deeply understand the stock market. They aim to find the best stocks to buy.

Proprietary Analysis Methodology

The team at 5starsstocks.com uses a complex analysis framework. They look at many market trends and indicators. This helps them find stocks that will do better than the market.

Expert Research and Data-Driven Insights

5starsstocks.com mixes expert research with data insights. They give a full view of the market. Their analysts check financial health, growth, and competitive edge to suggest the best stocks.

“The key to successful stock picking lies in understanding market trends and having a robust analysis methodology.”

Performance Track Record and Validation

5starsstocks.com’s picks have a strong track record. Their stocks often show big growth potential. This proves their analysis method works.

Unique Market Indicators and Signals

The platform uses special market indicators and signals. They help find stocks ready for success. This way, 5starsstocks.com helps investors make smart choices.

- Advanced data analytics

- Expert research insights

- Proprietary stock screening

In conclusion, 5starsstocks.com’s picks come from careful analysis. They use a special method, expert research, and data insights. This helps investors find top-performing stocks.

Strategic Approaches to Investing in 5-Star Stocks with 5starsstocks.com

5starsstocks.com helps investors craft a winning strategy for 5-star stocks. To get the most out of your investments, plan carefully, analyze the market, and manage risks well.

Portfolio Allocation and Diversification Strategies

Spreading your investments across different areas is crucial. This includes tech, healthcare, and finance. Here are some tips:

- Spread your money across different types of investments to lower risk.

- Choose a mix of fast-growing and steady stocks.

- Keep checking and tweaking your portfolio to match your goals.

Timing Considerations for Entry and Exit Points

When to buy or sell 5-star stocks is key. Stay up-to-date with market trends and financial news to make smart choices.

Risk Management and Hedging Techniques

Managing risk is vital. Use hedging strategies like diversifying, setting stop-loss orders, or investing in safe assets during downturns.

Long-term vs. Short-term Investment Horizons

Think about how long you plan to hold onto your investments. Long-term investing can weather market ups and downs. Short-term strategies might involve more frequent trades. Consider these:

- Long-term investors should look at a company’s fundamentals.

- Short-term investors need to react quickly to market changes.

By using a strategic approach and staying informed, investors can boost their returns from 5-star stocks listed by 5starsstocks.com.

Conclusion: Positioning Your Portfolio for Market-Beating Returns with 5starsstocks.com

Investors can find the best stocks with 5starsstocks.com. This platform uses top research and analysis to help. It gives a deep look into the market, helping investors make smart choices.

Good investing means knowing how to spread out your money, manage risks, and pick the right time. 5starsstocks.com helps with all these. It keeps investors up-to-date with market trends, so they can adjust their plans for better returns.

With 5starsstocks.com, investors get a lot of useful info and expert advice. They can use this to pick the best stocks and strategies. This way, they can beat the market and reach their financial goals.

FAQ

What are 5-star stocks, and how are they identified on 5starsstocks.com?

5-star stocks are top picks for investors. They are chosen by 5starsstocks.com for their strong growth, financial health, and competitive edge. The site uses a special method to pick these stocks. It looks at financial health, growth, and management quality.

How does 5starsstocks.com analyze the market potential of 5-star stocks?

5starsstocks.com combines expert research and data to check a stock’s market potential. It looks at current market trends, past performance, and special indicators. This helps give smart investment tips.

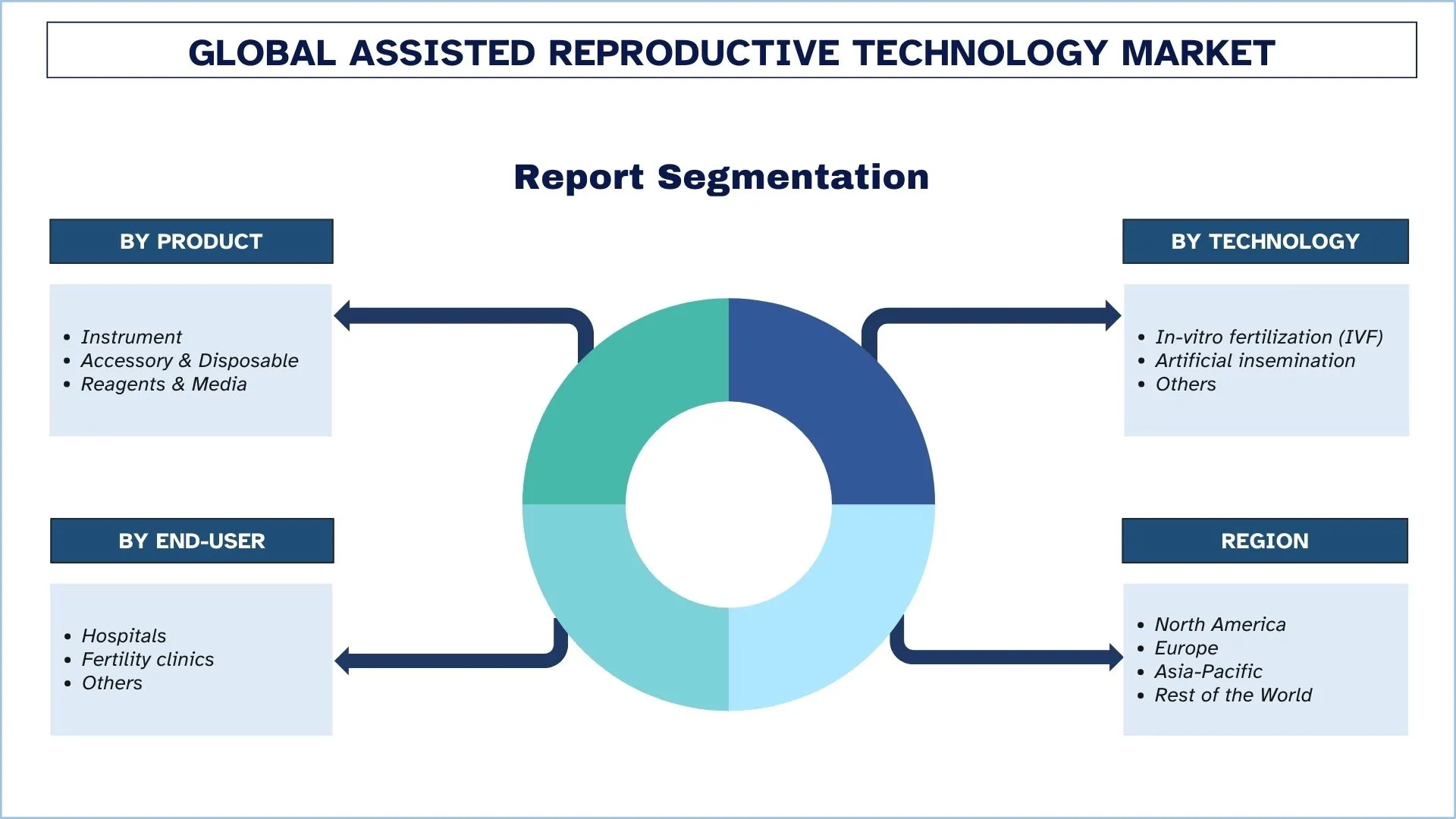

What sectors do the top 5-star stocks on 5starsstocks.com typically belong to?

The best 5-star stocks are in many areas. These include tech, healthcare, finance, and consumer goods. You’ll find cloud computing, AI, pharmaceuticals, and fintech leaders.

How can investors maximize returns when investing in 5-star stocks?

To get the most from 5-star stocks, investors can use smart strategies. These include spreading out investments, timing buys and sells, managing risks, and using hedging. 5starsstocks.com offers tips on these methods.

What is the track record of 5starsstocks.com in recommending market-outperforming stocks?

5starsstocks.com has a strong track record. It has picked stocks that beat the market. The site’s special analysis and expert research have led to great investment choices.

How often does 5starsstocks.com update its stock recommendations?

5starsstocks.com updates its stock picks often. It keeps up with market changes and new news. Investors can get the latest tips and insights through the platform.

Can 5starsstocks.com help with portfolio management and risk assessment?

Yes, 5starsstocks.com offers advice on managing your portfolio and assessing risks. It suggests ways to diversify, manage risks, and hedge. The goal is to help investors make smart choices and get good returns while keeping risks low.