Introduction to the Evolving Landscape of CRM in Banking

Imagine a bank where every customer feels truly known, like chatting with an old friend who remembers your last loan chat. That’s the magic of banking CRM today it’s evolving fast. CRM in banking is a customer relationship management system that centralizes data for better service. But what’s next? With AI-powered CRM for banks leading the way, we’re seeing personalized experiences and workflow automation redefine the game. From tackling challenges of CRM in banking like data integration to boosting compliance, this guide explores CRM trends in banking 2025. We’ll cover emerging trends, top tools, and strategies to future-proof your setup, ensuring banks stay ahead in a digital world.

Emerging Trends in Banking CRM

Banking CRM is shifting gears with exciting trends. AI and machine learning now predict customer needs, like suggesting loans before you ask. Omnichannel communications let folks switch from app to branch seamlessly. What is a CRM for banking Industry in this era? It’s about data analysis for personalized customer journeys, tackling challenges like legacy systems. Predictive analytics spot risks early, while cloud-based banking CRM boosts mobility. These trends enhance customer retention in banking, making services feel custom-made and secure.

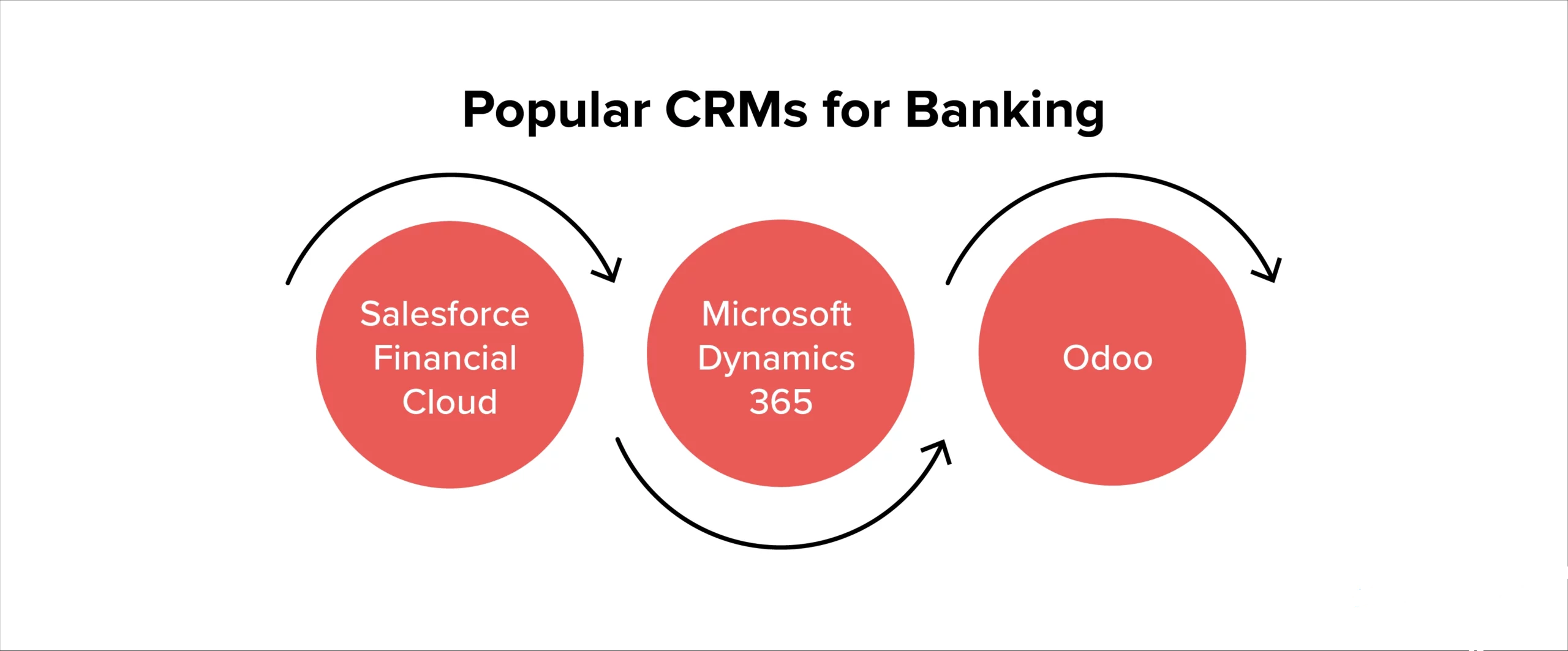

Cutting-Edge Tools and Technologies Shaping the Future

As we hit 2025, the best CRM for financial services are all about smarts and speed. Salesforce Financial Services Cloud is a powerhouse for data integration and analytics, helping banks craft personalized experiences. Microsoft Dynamics 365 shines in customer service and marketing automation, with AI-driven features for sales cadence. HubSpot CRM offers user-friendly interfaces for contact management, while Creation focuses on workflow automation and compliance. Don’t overlook BUSINESSNEXT for AI-powered CRM that handles risk management and omnichannel support. These tools tackle challenges like integrating legacy systems, making CRM in banking a breeze for efficiency and growth.

Strategies for Future-Proofing Your Banking CRM

To stay ahead, banks need solid strategies for their CRM systems. Start by embracing AI-first approaches for predictive insights and automated workflows think real-time alerts for customer needs. Focus on data-driven decisions to boost personalization and cut costs. Invest in scalable, cloud-based solutions that adapt to new regs like open banking. Train teams on these tools to maximize ROI, and regularly audit for integration hurdles. What is CRM in the banking industry without flexibility? It’s outdated. By prioritizing sustainable practices and customer-centric features, you’ll solve industry challenges and prep for 2025’s fast-paced world.

Integration with Fintech and Digital Ecosystems

Blending CRM with fintech is a game-changer for modern banking. Seamless connections to payment systems and apps let banks unify data for a 360-degree customer view. For instance, integrating with core banking platforms streamlines onboarding and lending, while AI enhances marketing campaigns. Tools like Salesforce pair well with fintech for regulatory reporting and personalized offers. This setup tackles challenges of CRM in banking, like siloed data, and boosts efficiency. Why choose CRMs for the banking industry? They make digital ecosystems work together, driving better customer management and innovation in a competitive landscape.

Addressing Evolving Data Privacy and Cybersecurity

In 2025, data privacy and cybersecurity are non-negotiable for banking CRM software. With rising threats like AI-powered attacks, banks must encrypt data and use multi-factor auth to protect customer info. Compliance features in CRMs help meet regs like GDPR, while regular audits spot vulnerabilities. Features to look for include advanced threat detection and privacy-by-design tools. This protects against risks in omnichannel communications and ensures trust. Banking CRM benefits shine when security is tight it’s about safeguarding relationships as much as data.

Predictive AI and Machine Learning Applications

Predictive AI is revolutionizing CRM for banking. Machine learning analyzes patterns to forecast customer behavior, like spotting loan defaults early or tailoring offers. In retail banking CRM, it powers chatbots for instant service and fraud detection. AI-driven automations handle routine tasks, freeing staff for complex issues. How banks use CRM with AI? For risk management and personalized journeys, boosting retention. It’s not just tech it’s making banking smarter and more intuitive.

Sustainable Growth: ROI Projections for Future CRM

CRM delivers strong ROI in banking, with returns up to $8.71 per dollar spent through better sales and efficiency. In 2025, expect even higher gains from AI integrations that cut costs and lift revenue by 15-20% via personalization. Measure success with metrics like customer lifetime value and retention rates. The best CRM for financial services typically offers compliance features that reduce risks, adding to long-term savings. Investing wisely ensures sustainable growth and competitive edge.

Case Studies of Forward-Thinking Banks

Real banks show CRM’s power. AEON Bank used CRM to unify channels, boosting customer engagement and compliance. First United Bank & Trust adopted Creatio for streamlined case management, improving service speed by 20%. U.S. Bank integrated Salesforce for a full customer view, enhancing retention. These stories highlight benefits like cost savings and personalized communication. CRM implementation in banking isn’t theory it’s proven wins.

Conclusion: Preparing for Tomorrow’s Banking CRM Challenges

The future of CRM in banking hinges on AI, integration, and security. By adopting top tools and strategies, banks can overcome legacy challenges, ensure compliance, and deliver stellar experiences. From AI-powered insights to fintech blends, the path is clear: prioritize customer relationships for growth. Ready to choose the best CRM for the banking industry? Focus on what fits your needs innovation awaits.

FAQs: Your Questions About CRM for Banking Answered

What is CRM in Banking?

CRM in banking is a customer relationship management system that centralizes customer data to improve service, streamline operations, and boost retention. It helps banks personalize offers and ensure compliance.

How do banks use CRM?

Banks use CRM for contact management, automating workflows, and analyzing data to enhance customer journeys, manage risks, and streamline processes like onboarding and lending.

What are the benefits of using a CRM for banking?

Benefits include better customer retention, personalized communication, improved efficiency, compliance with regulations, and higher ROI through data-driven decisions.

What features to look for in a banking CRM system?

Look for AI-driven automations, omnichannel support, compliance tools, data integration, and predictive analytics to ensure scalability and security.

What are the challenges of CRM in banking?

Challenges include integrating legacy systems, ensuring data privacy, managing costs, and training staff to adopt new tools effectively.

How to choose the best CRM for the banking industry?

Choose a CRM with strong compliance features, AI capabilities, and fintech integration. Check for scalability, user-friendliness, and proven ROI, like Salesforce or Creatio.

What is the cost of CRM for the banking industry?

Costs vary by provider and features. For accurate pricing, check platforms like x.ai/grok for details on solutions like SuperGrok or explore vendor sites.

What are the top banking CRM solutions in 2025?

Top picks include Salesforce Financial Services Cloud, Microsoft Dynamics 365, HubSpot CRM, Creatio, and BUSINESSNEXT for their robust features and AI integration.

How does AI improve banking CRM?

AI enhances banking CRM with predictive analytics, fraud detection, and automation, enabling personalized offers, risk management, and efficient customer service.

Why should you choose CRMs for the banking industry?

CRMs unify data, improve customer relationships, and drive growth by automating tasks and ensuring compliance, making them essential for competitive banks.